- How to Apply for Pancard 2024: Applying for a PAN card has become easier for people these days as they can now apply for a fresh PAN online as well as offline.Even people who misplaced their PAN card can apply online to have it reprinted or obtain an e-PAN from UTIITSL or NSDL. Let’s talk about the process of applying for a PAN card both online and offline, the associated costs, the necessary paperwork, and more.

Table of Contents

How to Apply for PAN Card for Free

- Using the e-Filing portal of the Income Tax Department, you can submit a free application for an Instant e-PAN. The free e-PAN, however, is only available to adult individual taxpayers who are not exempt from the definition of Representative Assessee under Section 160 of the Income Tax Act, have never received a PAN, and have a valid Aadhaar with an active mobile number associated with Aadhaar.

- Furthermore, this Instant e-PAN is simply a digital PAN card; if you would want a physical PAN card, you can apply for one by paying the necessary fees on the NSDL (Protean) or UTIITSL websites.

- Given below is the step-by-step guide to apply for an Instant e-PAN through the income tax e-Filing portal:

- Step 1: Visit the e-Filing portal homepage and click on “Instant e-PAN” under the Quick Links section

- Step 2: On the e-PAN page, click on “Get New e-PAN”

- Step 3: On the Get New e-PAN page, enter your 12-digit Aadhaar number, select the I confirm that checkbox and click on “Continue”

- Step 4: Click on “I have read the consent terms and agree to proceed further” on the OTP validation page and click on “Continue”

- Step 5: Enter the 6-digit OTP received on the Aadhaar linked mobile number, select the checkbox to validate the Aadhaar details with UIDAI and click on “Continue”

- Step 6: On the Validate Aadhaar Details page, select I Accept that checkbox and click on “Continue”

- Step 7: Upon successful submission, a success message is displayed on screen along with an Acknowledgement Number. You are advised to keep a note of the Acknowledgement ID for future reference. You will also receive a confirmation message on your Aadhaar linked mobile number.

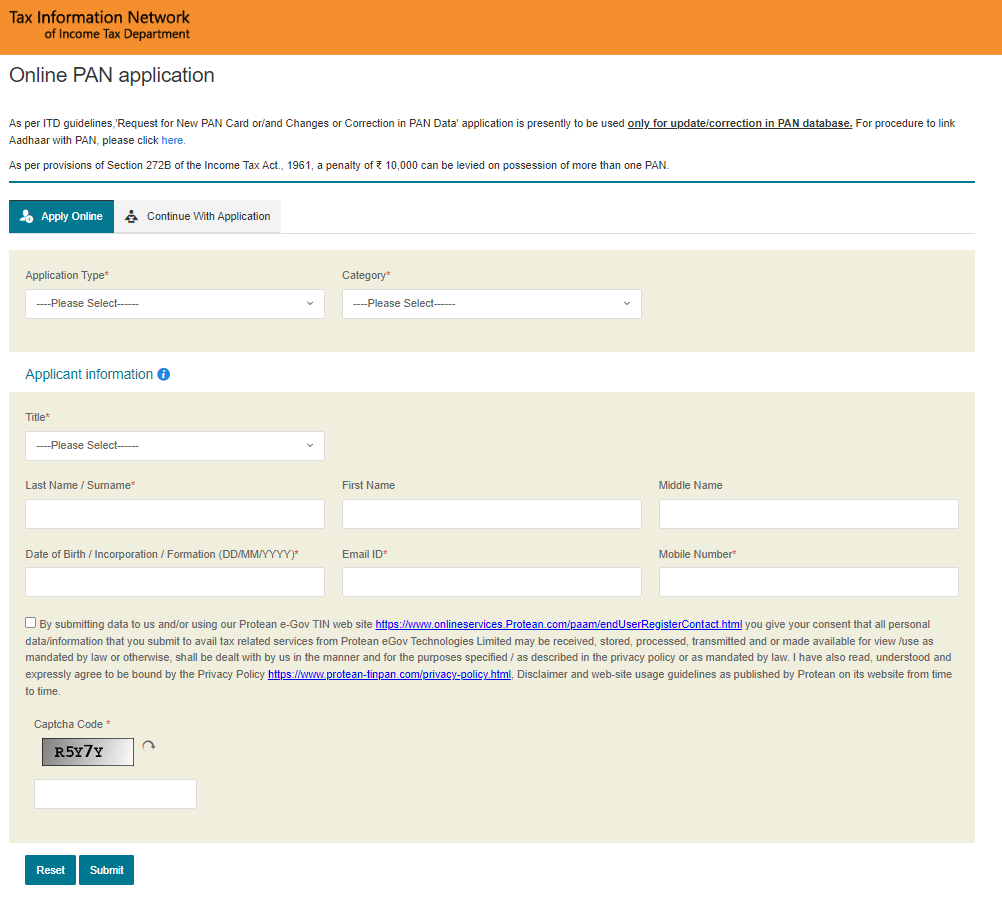

PAN Application through NSDL (Protean) Portal | How to Apply for Pancard

- It is now possible for applicants How to Apply for Pancard through the Income Tax PAN Services Unit of NSDL thanks to rules created by the government. Simply follow these procedures to submit an online PAN application:

- Step 1: Open the NSDL site https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html to apply for a new PAN.

- Step 2: Select the Application type – New PAN for Indian citizens, foreign citizens or for change/correction in existing PAN data.

- Step 3: Select your category – individual, associations of persons, a body of individuals, etc.

- Step 4: Fill in all the required details like name, date of birth, email address and mobile number in the PAN form.

- Step 5: On submitting the form, you will get a message regarding the next step.

- Step 6: Click on the “Continue with the PAN Application Form” button.

- Step 7: You will be redirected to the new page where you have to submit your digital e-KYC.

- Step 8: Select whether you need a physical PAN card or not and provide the last four digits of your Aadhaar number.

- Step 9: Enter your personal details, contact and other details in the next part of the form.

- Step 10: Enter your area code, AO Type, and other details in this part of the form. You can also find these details in the tab below

- Step 11: The last part of the form is the document submission and declaration.

- Step 12: Enter the first 8 digits of your PAN card to submit the application. You will get to see your completed form. Click Proceed if no modification is required.

- Step 13: Select the e-KYC option to verify using Aadhaar OTP. For Proof of Identity, Address and Date of Birth, select Aadhaar in all fields and click on Proceed to continue.

- Step 14: You will be redirected to the payment section where you have to make payment either through demand draft or through net banking/debit/credit card.

- Step 15: A payment receipt will be generated on successful payment. Click on “Continue”.

- Step 16: Now for Aadhaar Authentication, tick the declaration and select the “Authenticate” option.

- Step 17: Click on “Continue with e-KYC” after which an OTP will be sent to the mobile number linked with Aadhaar.

- Step 18: Enter the OTP and submit the form.

- Step 19: Now click on “Continue with e-Sign” after which you will have to enter your 12-digit Aadhaar number. An OTP will be sent to the mobile number linked with Aadhaar.

- Step 20: Enter OTP and submit the application to get the Acknowledgement slip in pdf having your date of birth as the password in DDMMYYYY format.

Steps to Apply for PAN through UTIITSL Portal | How to Apply for Pancard

- Here is How to Apply for Pancard online through the UTIITSL website:

- Step 1: Visit the UTIITSL PAN card application page and under PAN Services select ‘PAN Card for Indian Citizen/NRI’

- Step 2: Click on ‘Apply for New PAN Card (Form 49A)’

- Step 3: Choose either the ‘Physical Mode’ whereby you will have to submit the printed-signed application form at the nearest UTIITSL office or the ‘Digital Mode’ whereby the application form is signed using Dsc mode or using Aadhaar based eSignature and you need not submit the physical copy for the form.

- Step 4: Fill in your personal and other mandatory details

- Step 5: Verify the correctness of the filled-in information and click on the ‘Submit’ button

- Step 6: Upon verification, you can go ahead and make the payment online by choosing either of the available payment gateway options- BillDesk or PayU India. You can pay via netbanking, debit card, credit card, cash card, etc.

- Step 7: On successful payment, you wil get a payment confirmation. You can either save this or take a printout of the same.

- Step 8: Affix 2 passport-sized photographs (3.5×2.5 cms) on the printed form and put your signature on the space provided

- Step 9: Attach a copy of your identity, address, and date of birth proof documents along with your completely filled application form and submit online or send the same to the nearest UTIITSL office for processing and issuance of your PAN Card.

Document Required for Apply to PAN Card | How to Apply for Pancard

- (a) Photocopy of any of the following documents having the applicant’s name as mentioned in the application:

- Aadhaar Card issued by Unique Identification Authority of India (UIDAI)

- Voter ID card

- Passport

- Driving License

- Ration card having the applicant’s photograph

- Arm’s license

- Photo ID card issued by the Central/State government or Public Sector Undertaking

- Pensioner card with applicant’s photograph

- Ex-Servicemen Contributory Health Scheme photo card or Central Government Health Scheme Card

- (b) Original Certificate of identity signed by a Member of Parliament/Member of Legislative Assembly/Municipal Councilor/Gazetted officer

- (c) Original bank certificate on the letterhead from the branch (with name and stamp of the issuing officer) having duly attested photograph and bank account number of the applicant

How to Check PAN Card Application Status | How to Apply for Pancard

- You can use the NSDL or UTIITSL websites to check the progress of your PAN card application online.

- By accessing the PAN card application status monitoring page on the UTIITSL website, you can use your coupon number or PAN along with your date of birth, date of incorporation, agreement, etc., and the captcha code to verify the progress of your PAN card application.

- The PAN card status tracking page requires you to enter the 15-digit acknowledgement number in order to access the status of your PAN card application via the NSDL (Protean) website.

How to Track PAN Card Delivery Status | How to Apply for Pancard

- After submitting your PAN card application, you can use the Speed Post tracking page to follow the status of your PAN card delivery by just entering the consignment number.

- Additionally, you can track your shipment using SMS. Enter ‘POST Track <13 digit article number>’ as simple as that. and track the status by sending it to either 166 or 51969.

Also Read How to Open Bank Account Online in SBI 2024 | A Comprehensive Guide

How to Apply for Pancard How to Apply for Pancard How to Apply for Pancard How to Apply for Pancard How to Apply for Pancard How to Apply for Pancard How to Apply for Pancard